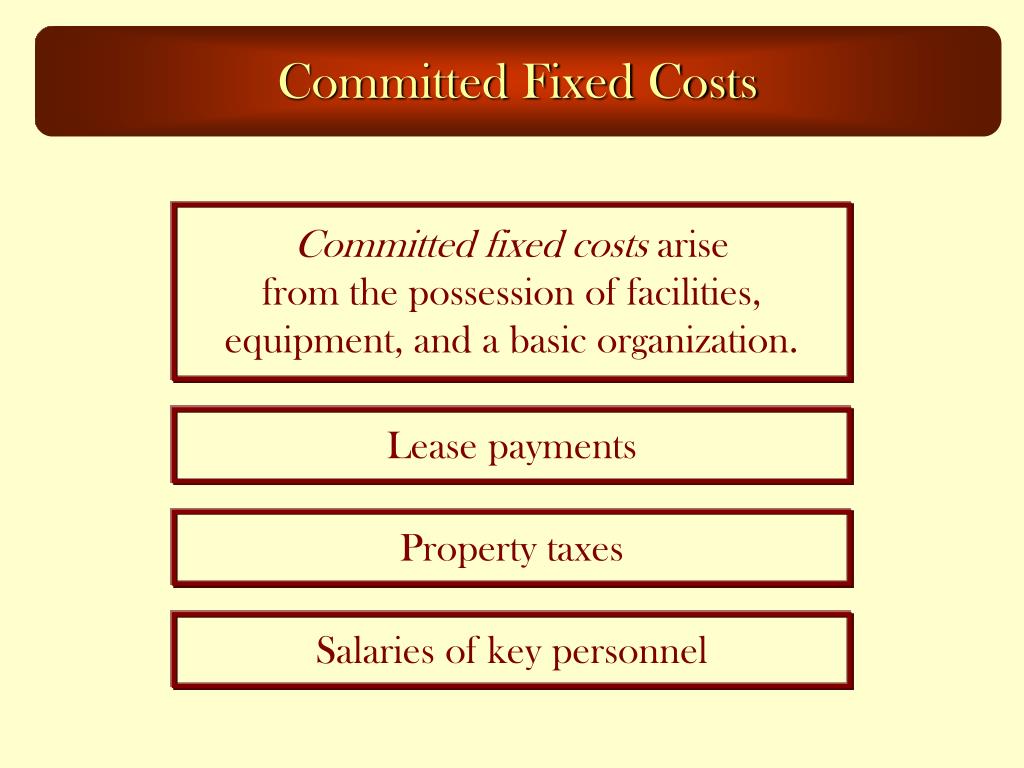

These costs can be reduced or modified without significant impact on the short-term day to day operations of the entity. Committed fixed costs are those fixed costs which are incurred due to certain past commitments of the entity. Management commits to undertake these costs for a specified time period.

The Company

They remain fixed per unit of production but change in total based on the level of activity within the business. We see that total fixed costs remain unchanged, but the average fixed cost per unit goes up and down with the number of boats produced. As more units are produced, the fixed costs are spread out over more units, making the fixed cost per unit fall. Likewise, as fewer boats are manufactured, the average fixed costs per unit rises. Committed fixed costs and discretionary costs are two types of expenses that businesses incur.

How much will you need each month during retirement?

As the business expands or contracts, discretionary costs can be adjusted accordingly. For example, a business experiencing rapid growth may choose to increase its marketing and advertising expenses to capture a larger market share. Conversely, during a period of low demand, the business may reduce its marketing expenses to minimize costs. As defined earlier, the relevant range is a term used to describe the range of activity (units of production in this example) for which cost behavior patterns are likely to be accurate. The relevant range for total production costs at Bikes Unlimited is shown in Figure 2.8 “Relevant Range for Total Production Costs at Bikes Unlimited”. It is up to the cost accountant to determine the relevant range and make clear to management that estimates being made for activity outside of the relevant range must be analyzed carefully for accuracy.

- Ultimately, businesses strategically group costs in order to make them more useful for decision-making and planning.

- However, the variable costs change in total as the number of units produced increases or decreases.

- In effect, they will double the relevant range to allow for a maximum of 160 inspections per shift, assuming the second QA inspector can inspect an additional 80 units per shift.

- In managerial accounting, different companies use the term cost in different ways depending on how they will use the cost information.

- This short-term period will vary depending on the company’s current production capacity and the time required to change capacity.

Activity Sampling (Work Sampling): Unveiling Insights into Work Efficiency

Assume the cost of direct materials (wheels, seats, frames, and so forth) for each bike at Bikes Unlimited is $40. If Bikes Unlimited produces one bike, total variable cost for direct materials amounts to $40. If Bikes Unlimited doubles its production to two short term payday loans online bikes, total variable cost for direct materials also doubles to $80. Variable costs typically change in proportion to changes in volume of activity. If volume of activity doubles, total variable costs also double, while the cost per unit remains the same.

Step 2 of 3

However, Susan also made Eric (CFO) aware that Bikes Unlimited was quickly approaching full capacity. If sales were expected to increase in the future, the company would have to increase capacity, and cost estimates would have to be revised. If, at any point, the average variable cost per boat rises to the point that the price no longer covers the AVC, Carolina Yachts may consider halting production until the variable costs fall again. The point at which the line intersects the y-axis represents the total fixed cost ($10,000), and the slope of the line represents the variable cost per unit ($7). When labor costs are incurred but are not directly involved in the active conversion of materials into finished products, they are classified as indirect labor costs. For example, Carolina Yachts has production supervisors who oversee the manufacturing process but do not actively participate in the construction of the boats.

Relocation would require a business to stop and then restart again once a new facility was found. Total fixed costs are the sum total of the producer’s expenditures on the purchase of constant factors of production. The factors of production include capital, land, labor, and enterprise. Examples of fixed factors of production include rent on the factory, interest payment, salary of permanent staff, etc.

Controllable costs are considered when the decision of taking on the cost is made by one individual. Common examples of controllable costs are office supplies, advertising expenses, employee bonuses, and charitable donations. Controllable costs are categorized as short-term costs as they can be adjusted quickly. Sunk costs are historical costs that have already been incurred and will not make any difference in the current decisions by management.

But, it is equally important to identify business models that simply will not work. If you’ve ever flown on an airplane, there’s a good chance you know Boeing. The Boeing Company generates around \(\$90\) billion each year from selling thousands of airplanes to commercial and military customers around the world.

Fixed production costs were $3,000, and variable production costs amounted to $1,400 per unit. Fixed selling and administrative costs totaled $50,000, and variable selling and administrative costs amounted to $200 per unit. As you have learned, much of the power of managerial accounting is its ability to break costs down into the smallest possible trackable unit. In many cases, businesses have a need to further refine their overhead costs and will track indirect labor and indirect materials.

One graph reveals that total variable cost increases in a linear fashion. When plotted on a “per unit” basis, the variable cost is constant at $11 per unit. Period costs are simply all of the expenses that are not product costs, such as all selling and administrative expenses. It is important to remember that period costs are treated as expenses in the period in which they occur. In other words, they follow the rules of accrual accounting practice by recognizing the cost (expense) in the period in which they occur regardless of when the cash changes hands. For example, Bert pays his business insurance in January of each year.